Annuities

Retirement planning

An annuity can offer solutions to needs such as a safe retirement accumulation, a guaranteed life time income, and even a probate free transfer of assets at death. Annuities are currently paying many times better than the average bank CD.

Annuities vs. Bank CD’s

Although only life insurance companies can issue annuities in the United States, the investment vechicles are marketed by many different types of organizations and individuals. Some of the key entities who offer these products include:

- Banks

- Life insurance agents and brokers

- Stockbrokers and registered Investment Advisors

- Financial planners

- Estate and trust officers

- Mutual fund companies

‘

Types of Annuities

Basically, there are 3 types of Annuities that we offer for specific needs our clients may have.

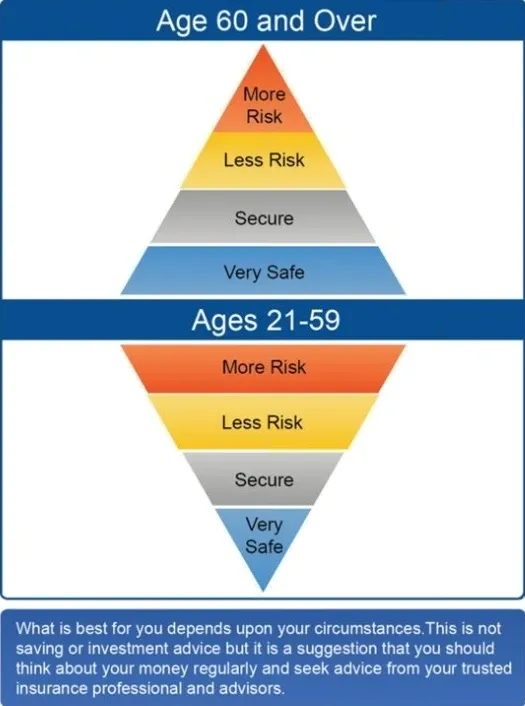

1. Fixed Annuities – Appropriate for conservative investors who want or need a guarantee of principal and interest.

2. Indexed Annuities – Appropriate for moderate investors who want to participate in the markets without risking their principal.

3. SPIA (Single Premium Immediate Annuity) – Appropriate for investors that desire to obtain an immediate income stream for life, or a period certain, that can never be out lived.

Everyone has specific needs and goals for their savings, although they can change over time.

Calculate Your Required Minimum Distribution From IRAs

Six reasons why to consider a fixed undexed annuity (FIA)

Accumulate for retirement

FIAs offer the potential to earn interest based on changes in an external index. We offer annuities to give you a choice of several indexes and even some exclusive index options.

Protect your principal

Your annuity can earn interest based on an external index, but you’re not actually buying any stocks or shares of an index. This means the money in your FIA (your ‘principal’) is not at risk due to market losses.

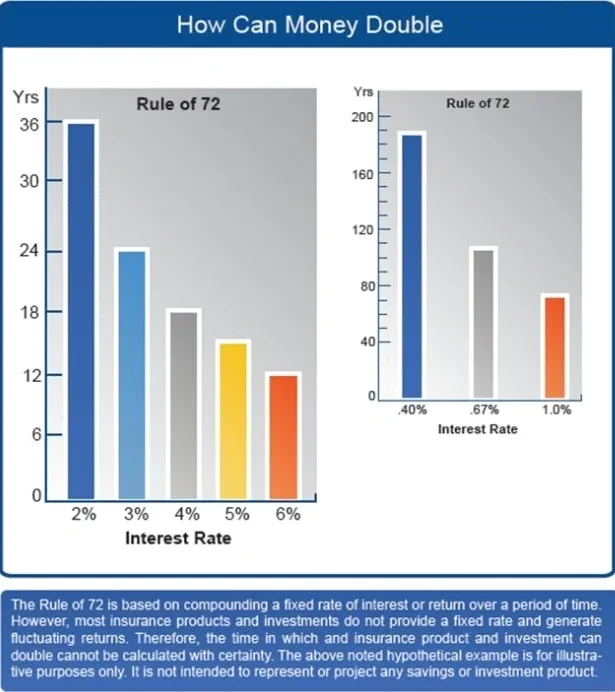

Grow tax-deferred

You don’t pay taxes on the interest your annuity earns until you take money out. This helps compound your interest, so the money in your contract can accumulate faster.

Get flexibility

Some FIAs offer riders (either built in or at an additional cost) to help you address specific needs. They also offer a variety of crediting methods and flexible options for receiving income.

Receive guaranteed income

Annuities are designed to provide a reliable stream of retirement income, either for a set period or for as long as you live. Some FIAs even offer you the potential to get increasing income.

Leave a legacy

FIAs pay your loved ones a death benefit if you pass away before you start taking scheduled annuity payments. (And, if properly structured, the death benefit is not subject to probate.)

We are a full service Life/Health/Retirment Planning agency located in Lafayette Indiana, although we are licensed to do business in Illinios, Michigan, and Texas as well. We strive to have one of the largest portfolios available to independant agencies like ours so that we can always offer our clients the best value for thier hard earned money.

We are a full service Life/Health/Retirment Planning agency located in Lafayette Indiana, although we are licensed to do business in Illinios, Michigan, and Texas as well. We strive to have one of the largest portfolios available to independant agencies like ours so that we can always offer our clients the best value for thier hard earned money.