September is Life Insurance Awareness Month – and as we get back into our fall routines some of us need to reflect and be sure that we are sufficiently covered if the worst should happen. Give us a call and we can help!

Life Insurance

When we are young our responsibilities are high, we have mortgages, young children, and a lifetime of income that a surviving spouse would miss. As life goes by those needs may change as money for college educations, weddings, retirement income, and even long-term care start becoming real needs. Solutions to these needs, and many more, can be met with creative and modern life insurance products for all ages.

Did you know?

…85 percent of consumers agree that most people need life insurance, yet just 62 percent say they have it.

Source: LIMRA’s Life Insurance Barometer Study 2013

Why having final Expense insurance in Important

Get a free quote

Final expense life insurance plans can act as a “clean up” fund for those unexpected expenses following the death of a loved one. Expenses such as the final utility bills, mortgage payments, un-paid taxes, and even expenses not included in today’s pre-paid funeral plans can be an unexpected expense.

AVERAGE COST OF FINAL EXPENSES: Transfer of Deceased $250

Professional Services $1,817

Embalming $628

Casket & Vault $3,490

Memorial Service $125

Hearse $275

Facilities Charge $845

Graveside Service $325

TOTAL AVERAGE EXPENSES $7,755

Other cash payments, including cemetery plot, headstone, etc. $2,500

TOTAL COST $10,255*

Click here to find the average cost of a funeral in your area.

Universal Life and Term Life Plans

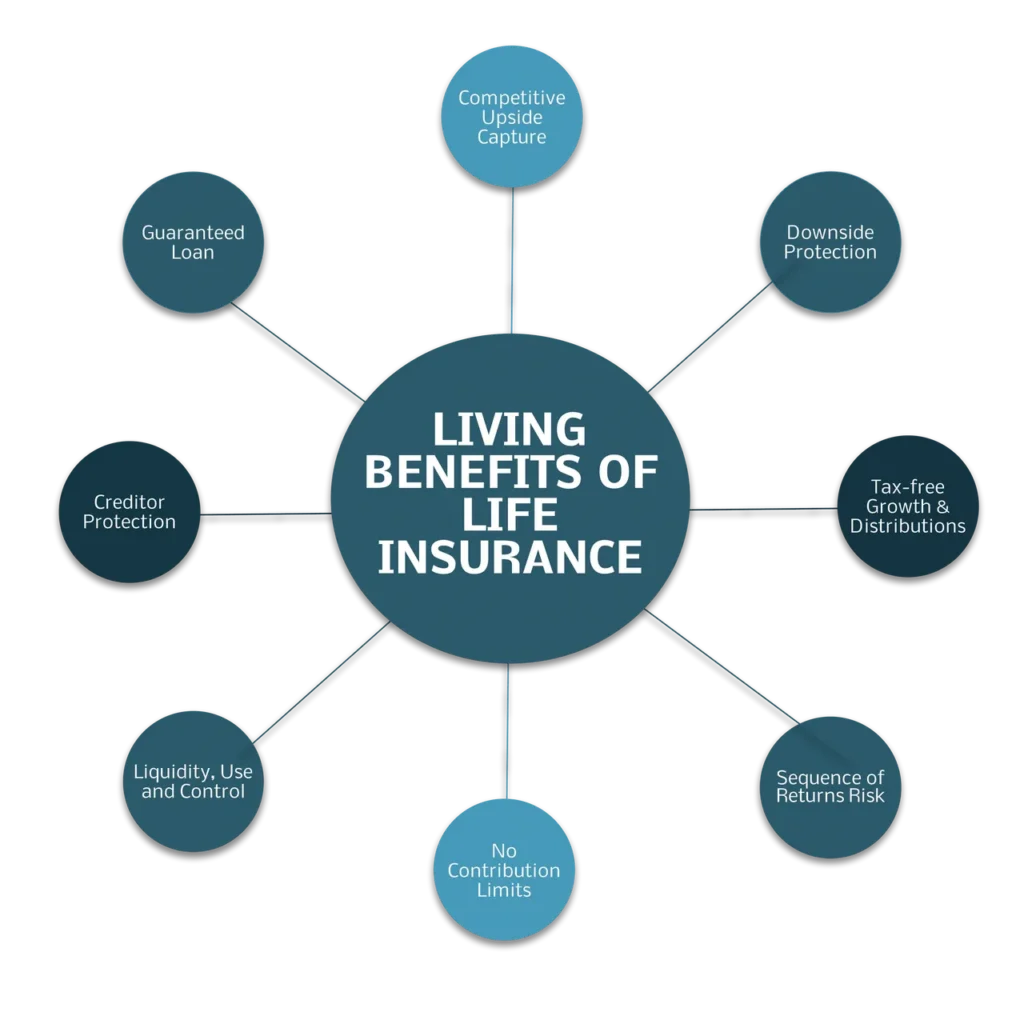

Modern Universal Life and Term Life plans now offer benefits not only at death, but in the event of critical illness, chronic illness, or a terminal illness… life insurance that pays if you don’t die!

Get a free term life quote

Indexed Universal Life Insurance explained.

Universal life insurance is a type of permanent life insurance coverage, offering both a death benefit and a cash value component. The policy will remain in effect for the lifetime of the insured individual, as long as the premiums are paid on time. We sell two types, indexed universal life and guaranteed universal life.

Policyholders can have flexible premiums or change their death benefit amount, which differs from other types of permanent life insurance policies. Plus, the cash value component offers potential to earn more interest; however, on the flip side, the value can go down over time.

More specifically, the cash value component earns interest based on a money market rate of interest or, for some types of universal policies, a rate that’s tied to a market index. Whatever you earn will increase your investment value, helping you pay your premium. Lowering your monthly payments can be useful if your financial situation changes.

Keep in mind that doing so will eat up your cash value – if there isn’t enough, you will need to make up the difference, or your policy will lapse.

We are a full service Life/Health/Retirment Planning agency located in Lafayette Indiana, although we are licensed to do business in Illinios, Michigan, and Texas as well. We strive to have one of the largest portfolios available to independant agencies like ours so that we can always offer our clients the best value for thier hard earned money.

We are a full service Life/Health/Retirment Planning agency located in Lafayette Indiana, although we are licensed to do business in Illinios, Michigan, and Texas as well. We strive to have one of the largest portfolios available to independant agencies like ours so that we can always offer our clients the best value for thier hard earned money.